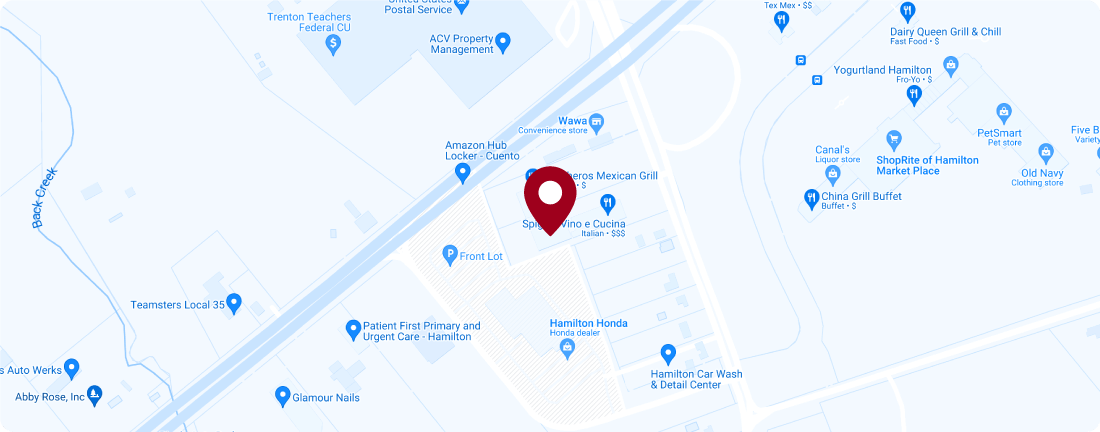

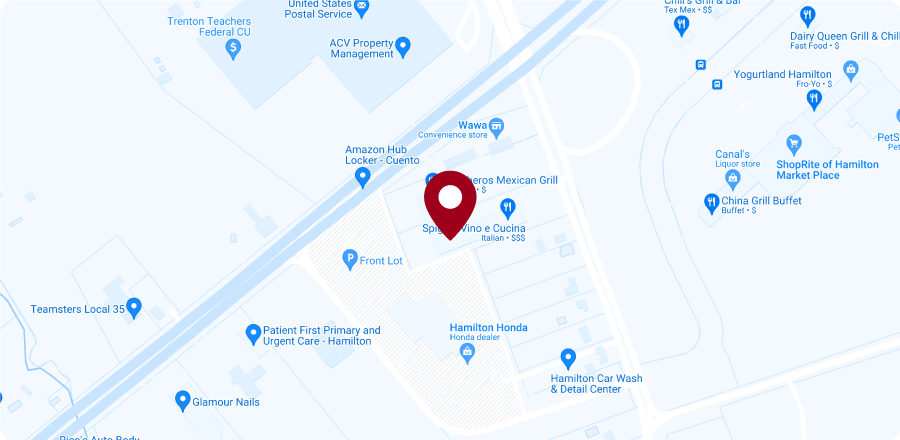

Our newest location just opened in Hamilton at 691 Route 130 North (behind the Wawa). We’d love to meet you!

Guaranteed growth.

Guaranteed safety.

Mature your portfolio in any economy.

For 80 years, we’ve helped members right here in our local community grow their wealth, regardless of financial turmoil—safely, securely and with ease. For example, our risk-free, high-earning 4.25% APY¹ Share Certificate is federally insured by the National Credit Union Administration (NCUA), guaranteeing the safety of your funds.

Couple this to further build your financial prosperity with a checking account offering a 3.51% APY² on balances up to $25,000—both offer yields far beyond the national averages. Set it, forget it and grow it with Credit Union of New Jersey.

The freedom to prosper.

Raising the bar for

risk-free earnings.

Earn 4.25% APY¹ with our 17-month certificate.

For that portion of your portfolio you don’t want to risk, invest in a high-earning Share Certificate from Credit Union of New Jersey. You’ll earn more than double the national certificate average³ with the federal backing of the NCUA. And it’s simple to set up. Just fill out the online form, and your money can start growing today.

Credit Union of New Jersey Share Certificates are insured up to $250,000 by the National Credit Union Association.

Your money stays in your community.

While your money grows safely and securely with Credit Union of New Jersey, it also gets channeled back into our community. It’s invested locally and loaned locally, so it comes full-circle right back to your neighbors.

We’re now located behind Wawa in the Deer Path Pavilion Shopping Center. 691 US Highway 130 in Hamilton, New Jersey.

Live outside of Hamilton? We’ve got locations in Ewing and Trenton.

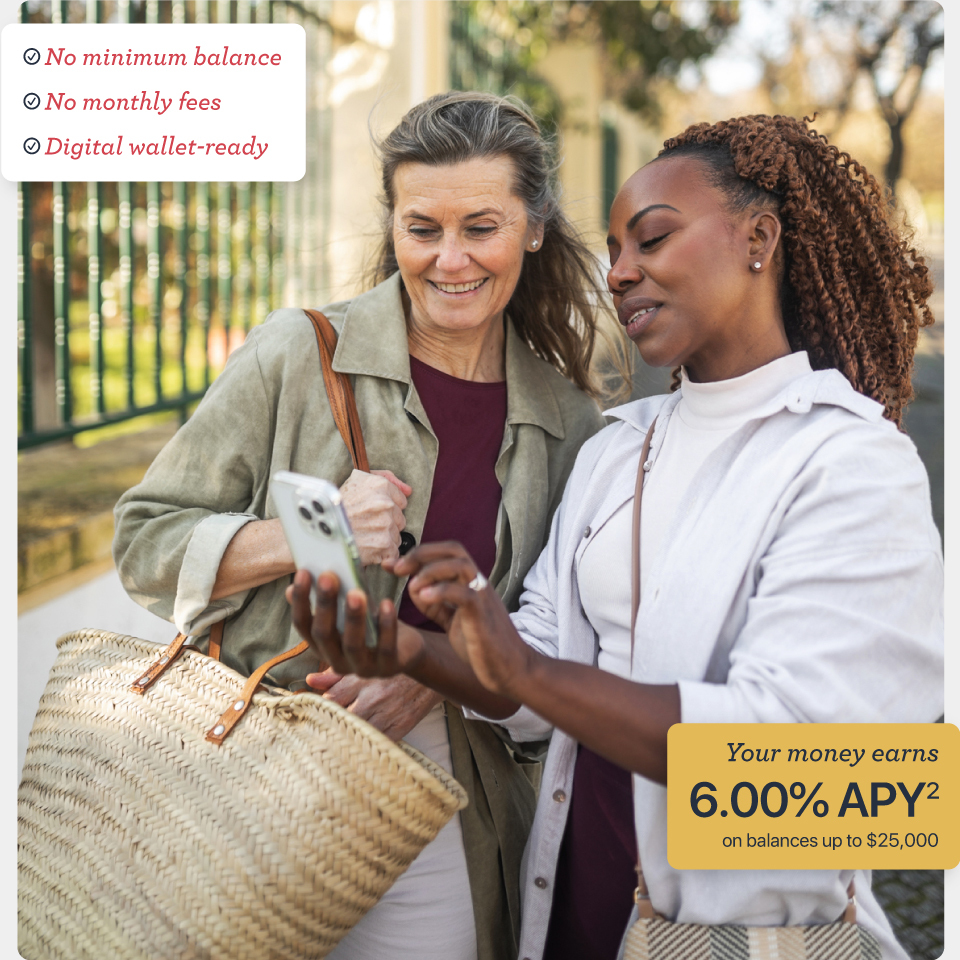

A checking account unlike any other.

Earn 6.00% APY² on balances up to $25,000.

Like your portfolio, checking accounts have also grown and diversified in recent years. Case in point: our Kasasa Cash® Checking Account that pays a stunning 6.00% APY² on balances up to $25,000—with no minimum balance and monthly fees. When you compare this to the average earned interest on checking accounts nationwide of just 0.06% APY⁴ well, you do the math.

How our Kasasa Cash Checking stacks up:

| Account | Earns Interest | Service Fees | ATMs |

|---|---|---|---|

| Credit Union of New Jersey Kasasa Cash Checking® | 30,000+ | ||

| Chase Total Checking® | 16,000+ | ||

| Bank of America Avantage Plus Banking® | 16,000+ | ||

| PNC Bank Virtual Wallet® Checking | 60,000+ | ||

| TD Bank Beyond Checking | 2,600+ | ||

| Santander Bank Select Checking | 2,000+ |

Sure. Your money grows here, but it can also perform to its full potential.

We specialize in more than just ways to grow your money. From investment strategies and business lending to HELOCs and rewards-based credit cards, we invite you to let our 80-year pedigree work for you.

Share Certificates

APY = Annual Percentage Yield. Rate is effective as of February 15, 2023, and is subject to change without notice. Penalty for early withdrawal may apply. Fees could reduce the earnings. A $5 Membership Account is required for this promotion. New money only. One certificate, business certificate or IRA certificate per person with a minimum deposit of $500 and a maximum deposit of $500,000. The 7-month certificate will renew as a 12-month certificate at the end of the 7-month period. The 13-month certificate will renew as a 12-month certificate at the end of the 13-month period. The 17-month certificate will renew as an 18-month certificate at the end of the 17-month period.

Kasasa Cash Checking

Qualification Information:

To earn your rewards, the following enrollments must be in place and all transactions and activities must post and settle to your Kasasa Cash account during each Monthly Qualification Cycle:

- At least 1 direct deposit, ACH credit, ACH payment or Bill Pay transaction(s)

- At least 12 PIN-based / signature-based debit card purchases

- Be enrolled in and have agreed to receive e-statements rather than paper statements

Account transactions and activities may take one or more days to post and settle to the account and all must do so during the Monthly Qualification Cycle in order to qualify for the account's rewards.

"Monthly Qualification Cycle" means a period beginning one (1) banking day prior to the first banking day of the current statement cycle through one (1) banking day prior to the last banking day of the current statement cycle.

Reward Information:

When your Kasasa Cash account qualifications are met during a Monthly Qualification Cycle, daily balances up to and including $25,000 in your Kasasa Cash account earn a dividend rate of 5.98% resulting in an APY of 6.00%; and daily balances over $25,000 earn a dividend rate of 0.75% on the portion of the daily balance over $25,000, resulting in a range from 6.00% to 1.80% APY depending on the account's daily balance.

You will receive reimbursements up to $25 for nationwide ATM withdrawal fees incurred within your Kasasa Cash account during the Monthly Qualification Cycle when qualifications are met. A foreign ATM fee reimbursement cap of up to $4.99 per transaction applies when qualifications are met. We reimburse ATM withdrawal fees based on estimates when the withdrawal information we receive does not identify the ATM withdrawal fee. If you have not received an appropriate reimbursement, we will adjust the reimbursement amount if we receive the transaction receipt within sixty (60) calendar days of the withdrawal transaction. NOTE: ATM fee reimbursements only apply to Kasasa Cash or Kasasa Cash Back transactions via ATM; Kasasa Saver ATM transaction fees are not reimbursed nor refunded. When your Kasasa Cash account qualifications are not met, ATM withdrawal fees are not refunded.

When your Kasasa Cash qualifications are not met, the dividend rate earned on the account's entire daily balance will be 0.01% resulting in an annual percentage yield of 0.01% and ATM withdrawal fees are not refunded.

Dividends will be credited to your Kasasa Cash account on the first processing/business day of the following statement cycle.

Nationwide ATM withdrawal fee reimbursements will be credited to your account on the first processing/business day of the following statement cycle.

APY = Annual Percentage Yield.

APYs accurate as of 09/01/2023.

APY calculations are based on an assumed balance of $25,000 + $100,000 in your Kasasa Cash account and an assumed statement cycle of thirty-one (31) days.

Rates, rewards, and bonuses, if any, are variable and may change after account is opened; rates may change without notice to you. No minimum balance is required to earn or receive the account's rewards. Rewards less than a penny cannot be distributed. Fees may reduce earnings.

Additional Information:

Membership restrictions may apply.

Account approval, conditions, qualifications, limits, timeframes, enrollments, log-ons and other requirements apply.

A $5 minimum deposit is required to open the account. Limit of one account per member.

There are no recurring monthly maintenance charges or fees to open or close this account.

Advertised information and rewards are based on all account qualifications being met during each cycle period.

Contact one of our credit union service representatives for additional information, account details, restrictions, reward calculations, processing limitations, cycle dates and enrollment instructions.

Federally insured by NCUA.

Trademarks: Kasasa and Kasasa Cash are trademarks of Kasasa, Ltd., registered in the U.S.A.

National Certificate of Deposit Yield Average

Data taken from Bankrate.com based on 3/2/2023 data stating the average yield is 1.58 percent for a one-year CD, 1.67 percent for a one-year jumbo CD, 1.20 percent for a five-year CD and 1.25 percent for a five-year jumbo CD.

Checking Account Earned Interest Data

APY = Annual Percentage Yield. Data taken from Businessinsder.com as of 2/15/2023. For more information visit https://www.businessinsider.com/personal-finance/average-bank-interest-rates

Auto Loans

Valid on new and used auto loans. Each auto loan closed during this promotion period will make no payments for 90 days. Accepting the terms of “no payment for 90 days offer” will extend the maturity of your loan for at least 90 days but less than 110 days. If accepting the delayed first payment, you will not be eligible for any other skipping/delaying of your payment during this calendar year. Interest will accrue during this period. Payments made through payroll deduction or automatic payment will be deposited into your account for the time you are skipping/delaying your payment. Refinances from existing CU of NJ loans do not qualify. All loans are subject to credit approval. Certain restrictions may apply. This offer can be discontinued at any time.